UBS Billionaire Ambitions Report Reveals How The Ultra-Rich Are Thriving Amid Rising Risks As North America Dominates – Financial Freedom Countdown

The UBS Billionaire Ambitions Report provides a detailed study of billionaire wealth in the current era. Over the past decade, it has tracked the growth, investment, and preservation of immense fortunes, alongside their role in shaping a positive impact on society for future generations.

In the recently released tenth-anniversary edition, the report reflects on its key findings from the past ten years, highlighting the most significant shifts and developments in billionaire wealth.

The global landscape is shifting, and the wealthiest individuals are on the move. As billionaires reassess their priorities in the wake of the pandemic, geopolitical tensions, and economic challenges, a trend is emerging that could have significant implications for your own financial plans.

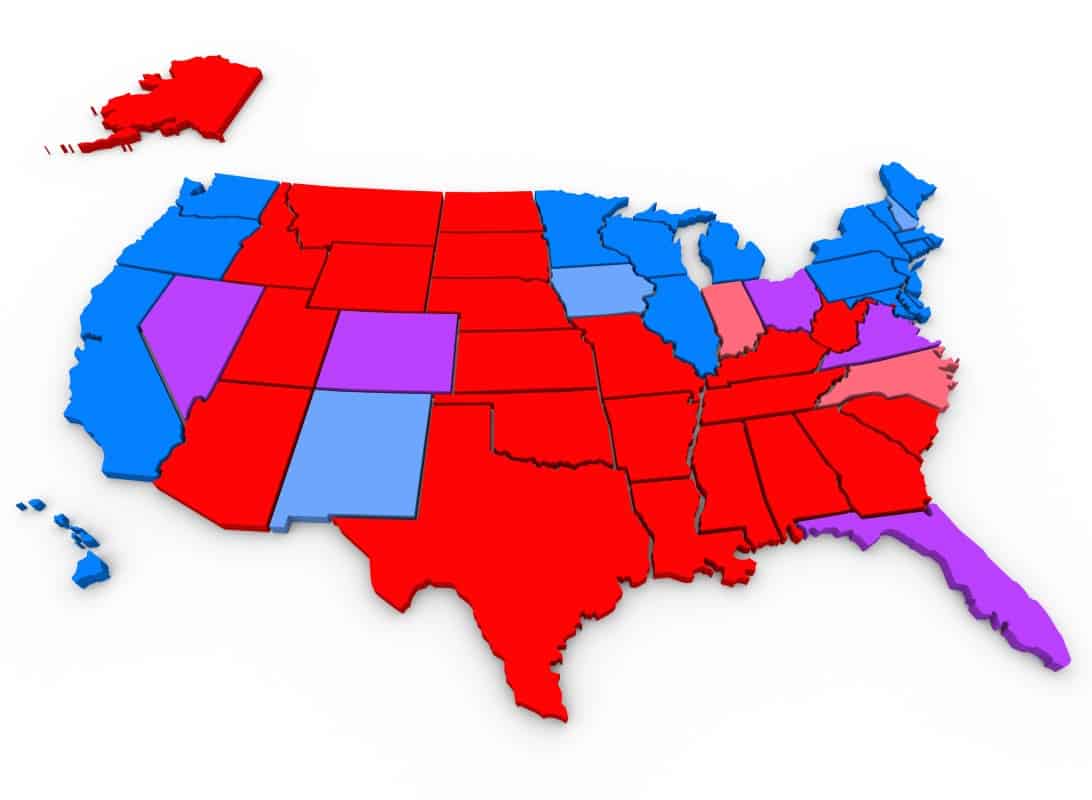

North America Dominates Billionaire Investment Plans

North America continues to be the top investment destination for the world’s wealthiest. Despite concerns about rising taxes and inflation, 80% of billionaires believe North America will provide the best returns over the next 12 months.

As they flock to the U.S., the question arises: is this the best place to put your money, or are other markets being left behind?

Tech Industry Still Reigns Supreme, But It’s Not Without Risks

Tech entrepreneurs continue to see the greatest wealth gains, particularly in sectors like AI and gaming. However, the volatility that comes with this sector means that even the wealthiest individuals are subject to sudden drops.

As the tech market fluctuates, can the average investor keep up, or are they at risk of major losses?

Wealth Redistribution: More Billionaires but Less Growth

While the number of billionaires globally has increased, their wealth is increasingly concentrated in specific regions, as newer regions like India emerge.

The global wealth gap continues to widen as billionaires thrive while the average investor faces stagnating returns. Can ordinary investors find a way to benefit from the wealth redistribution trend, or are they being left behind?

India’s Family Businesses: A Surprising Growth Story

India is seeing a significant rise in family-owned businesses, with billionaire wealth increasing by over 40% in just a decade.

However, India’s rapid ascent is a stark contrast to the decline of billionaire fortunes in China. While India’s growth seems promising, should investors be wary of emerging markets becoming increasingly risky?

Geopolitical Risk Trumps Everything Else

The growing threat of geopolitical instability weighs heavily on billionaire investment strategies. More than half of billionaires are concerned about major conflicts affecting their portfolios. This increased focus on security and stability underscores the reality that, for the super-wealthy, risk management is more crucial than ever.

The Family Dynamic: How Complex Wealth Structures Are Evolving

With families growing and wealth expanding across generations, billionaires are facing complex wealth management decisions.

As billionaires grow older, their focus is shifting toward wealth transfer and legacy building. But the complexities of multigenerational wealth planning are causing friction, with family members often divided on how to manage their fortunes.

Could the wealthy’s struggles with inheritance and succession planning mirror challenges you’ll face in managing your own estate?

Related: How to setup a revocable living trust

Political Instability Is a Major Investment Threat

As political divides widen, the richest are increasingly moving their assets to countries that offer political stability.

Between 2020 and 2024, a surprising 176 billionaires made the decision to move, driven by factors like healthcare, education, and safety.

With billionaire wealth flooding into the UAE, Switzerland, and Singapore, how are other nations impacted?

Real Estate and Equities: The Hot Commodities

Billionaires are significantly increasing their investments in real estate and equities, capitalizing on the post-pandemic recovery.

However, with the market showing signs of fragility, are these moves just temporary band-aids on a much bigger financial wound? What happens when the housing bubble bursts or the stock market hits a new low?

Shifting to Safe-Haven Assets for Market Stability

While billionaires have traditionally been known for their risk-taking behavior, the current climate of economic instability is pushing them to prioritize stability over high-risk ventures.

Will the shift from risk to safety lead to a prolonged market downturn, or are billionaires simply playing a different game than the average investor?

Billionaires are flocking to safe-haven assets like real estate, gold, and cash as they brace for global uncertainties. With geopolitical tension, inflation, and fears of a recession, the rich are clearly hedging against what could be a turbulent future.

Billionaires are increasingly turning to alternative assets like private equity and infrastructure to hedge against market volatility. As they diversify their portfolios, can ordinary investors also take advantage of these alternatives, or are they reserved for the ultra-wealthy?

Should you also consider diversifying your portfolio in similar ways to be prepared for any upcoming recession?

As billionaire wealth reaches new heights, the conversation around wealth inequality intensifies.

Even though billionaires are investing more in philanthropy, their total wealth continues to outpace the growth of most national economies. Could the rise of wealth inequality lead to policies that harm the very markets billionaires rely on?

Will the U.S. Continue to Be a Magnet for Billionaire Wealth?

U.S. billionaires saw a 27.6% increase in their collective wealth, but as the country’s financial landscape becomes more unstable, will this trend continue?

With more billionaires moving their fortunes abroad, is the U.S. losing its grip as the ultimate wealth hub?

Will the Wealth Gap Widen or Narrow?

As billionaires continue to accumulate unprecedented wealth, the divide between the super-rich and the average citizen grows ever wider. With billionaires investing in a diverse range of assets and opportunities, the question remains: Is there a way for the average person to close this gap, or is the playing field forever tilted?

Like Financial Freedom Countdown content? Be sure to follow us!

While many envision tax-friendly golden years, residents in nine states face a harsh reality as their Social Security benefits are taxed. In contrast, three states ended their practice of taxing these benefits for the 2024 calendar year. This shift highlights the complexities of retirement planning in the U.S. and underscores the importance of staying informed about changing tax laws. Are you living in one of these states? Discover how these tax changes might impact your retirement strategy and whether it’s time to reconsider your locale for those serene post-work years.

Retirees in These 9 States Still Face Social Security Taxes—While 3 Finally Got Relief For 2024

January 22, 2025, marked the disbursement of Social Security benefits reflecting the 2.5% cost-of-living adjustment (COLA). The Social Security Administration (SSA) has confirmed that beneficiaries with birthdays from the 21st to 31st of any month will receive their checks, as payments are distributed on the fourth Wednesday for this group. For retirees who maximized their benefits by waiting until age 70, the maximum monthly payout has increased to $5,108—up from $4,873 in 2024. Despite the modest increase, many recipients report that the adjustment isn’t enough to keep up with mounting costs.

Proposed legislation in the U.S. Senate aims to eliminate the “marriage penalty” in Social Security benefits for adults with intellectual or developmental disabilities. The Eliminating the Marriage Penalty in SSI Act (EMPSA), introduced by Senators Jerry Moran and Chris Van Hollen, seeks to protect recipients’ benefits from being reduced or eliminated due to marriage.

New Bill Shakes Up Social Security Benefits by Eliminating the ‘Marriage Penalty’—Here’s Who Gains

Deciding when to claim Social Security benefits is a critical decision for retirees. Two common strategies are claiming Social Security at age 62 and preserving retirement funds or using 401(k) savings and delaying Social Security until age 70. Each approach has its advantages and drawbacks, influenced by individual financial situations and goals.

Smart Retirement Planning: Should You Use Your 401(k) to Delay Social Security Until 70?

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.