Credit Card Defaults Skyrocket To 14-Year High As Americans Struggle Under Crushing Inflation – Financial Freedom Countdown

Americans are buckling under the weight of record-high consumer debt as credit card defaults surge to levels not seen since 2010.

According to a new report from the Federal Reserve Bank of New York, defaults jumped 50% in 2024 compared to the previous year.

Financial experts are raising alarms, warning that this could signal an approaching collapse as households struggle to manage rising balances and high-interest rates.

High Credit Card Balances

Credit card balances increased by $24 billion to hit $1.17 trillion in the third quarter of 2024 and are 8.1% above the level a year ago.

Such high utilization typically signals a strained financial situation.

Credit utilization is also a critical factor in determining credit scores, which assess the likelihood of future defaults.

Rising Credit Card Delinquencies

Missed credit card payments stem from a variety of causes including forgetfulness, cash flow issues, and income reduction.

Most of these factors are not easily detectable in individual credit data, but one clear indicator that often predicts future delinquencies is high credit card utilization.

During the first nine months of 2024, lenders wrote off more than $46 billion in seriously delinquent credit card loans.

That’s an increase of 50% from the first three quarters of 2023, and the highest since 2010.

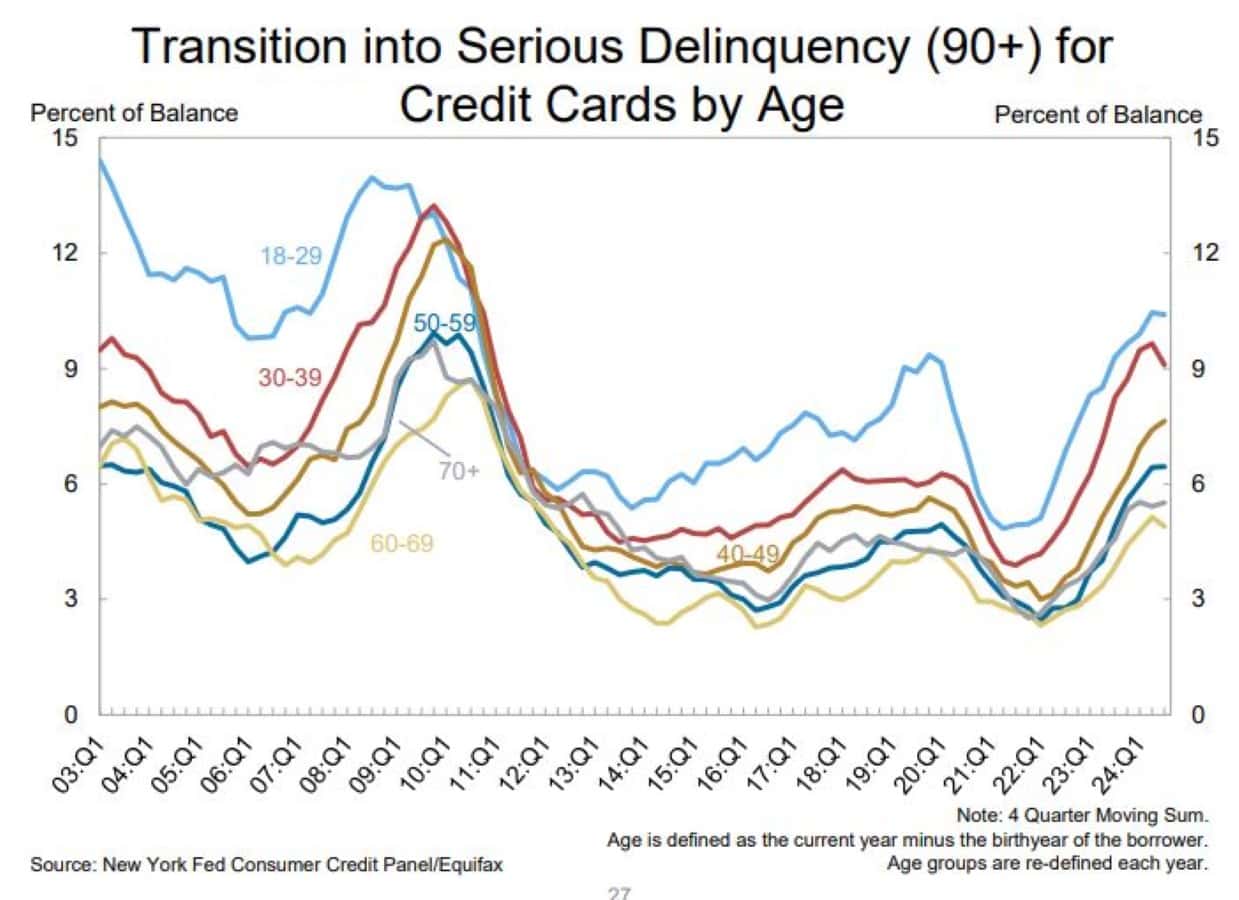

Delinquency for Credit Cards Broken Down by Age

Younger Americans are carrying a disproportionate delinquency risk on their credit card balances.

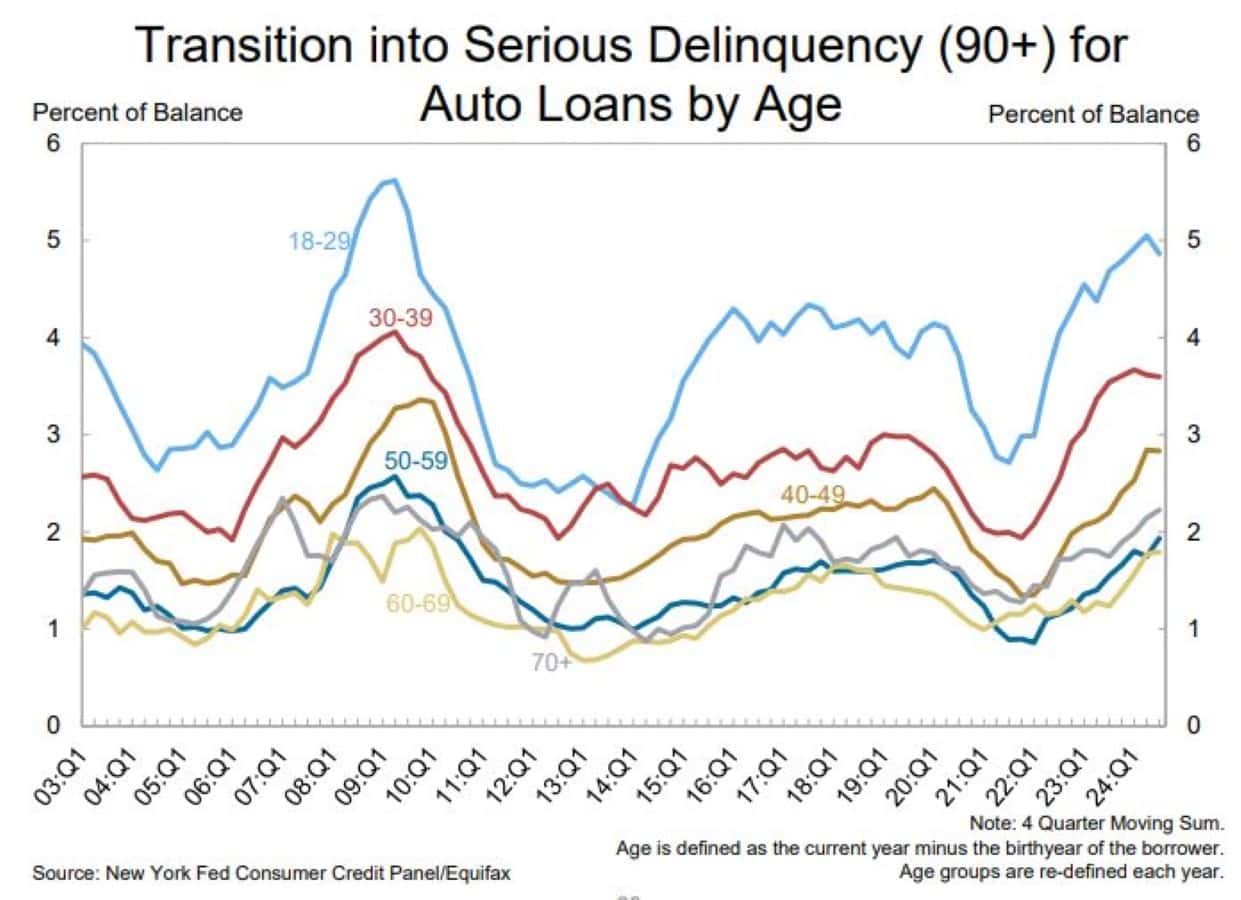

Delinquency for Auto Loans by Age

Similar age breakdown in terms of serious delinquencies for auto loans.

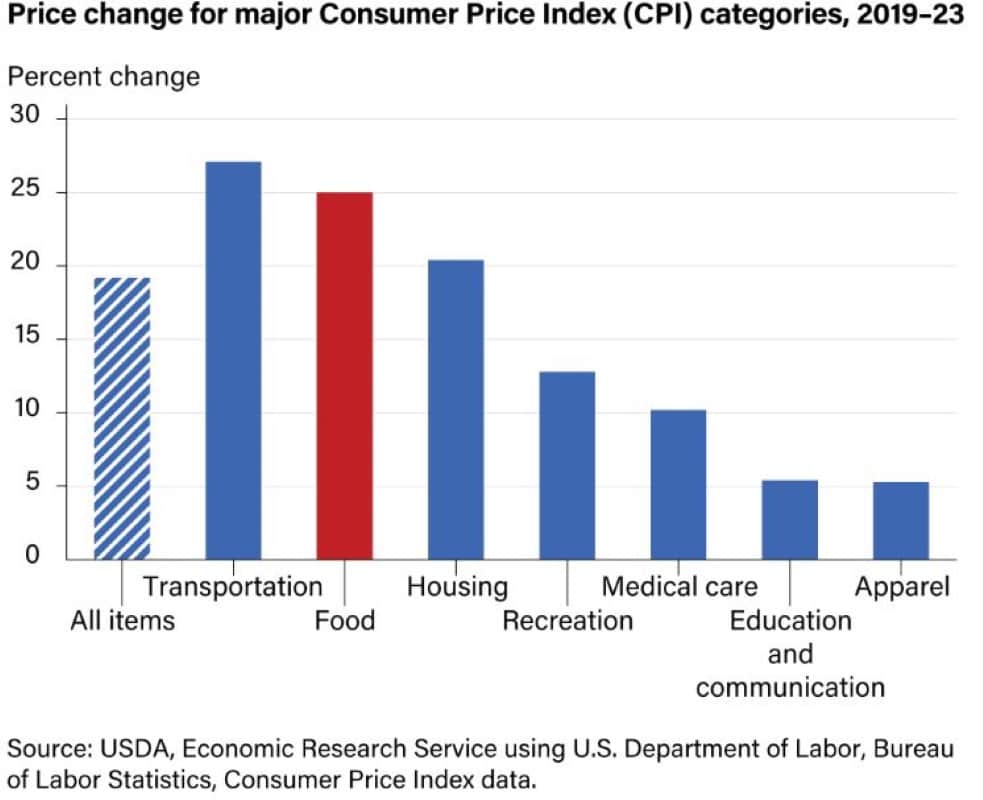

Surging Transportation, Food and Housing Costs Have Crushed Americans

Between 2019 and 2023, the all-food Consumer Price Index (CPI) surged by 25 percent, surpassing the growth rate of the all-items CPI, which stood at 19.2 percent during the same period as per USDA data. Essentials such as food prices saw a 25% increase while transportation costs increased by 27.1%.

Americans would have no choice but to resort to credit cards.

Household Debt Surged To $17.69 Trillion

Due to to rising inflation, Americans have been forced to go deeper into debt.

The latest report shows total household debt increased by $147 billion in Q3 2024, to $17.94 trillion.

Auto Loan Delinquencies Accelerating

Auto loan balances saw an $18 billion increase and stood at $1.64 trillion.

Housing Debt on the Rise

Mortgage balances rose by $75 billion from the previous quarter to reach $12.59 trillion at the end of September.

HELOC balances increased by $7 billion to reach $387 billion, representing the tenth consecutive quarterly increase since Q1 2022.

About 42,000 individuals had new foreclosure notations on their credit reports in the third quarter of 2024.

Student Loan Debt Increases

Outstanding student loan debt increased slightly and stood at $1.61 trillion in 2024 Q3.

Missed federal student loan payments will not be reported to credit bureaus until the fourth quarter of 2024. Because of these policies, less than 1% of aggregate student debt was reported 90+ days delinquent or in default will remain low until at least December of 2024.

With no additional student loan forgiveness expected, many students who were promised forgiveness by the Biden-Harris administration will start seeing defaults reported on their credit reports.

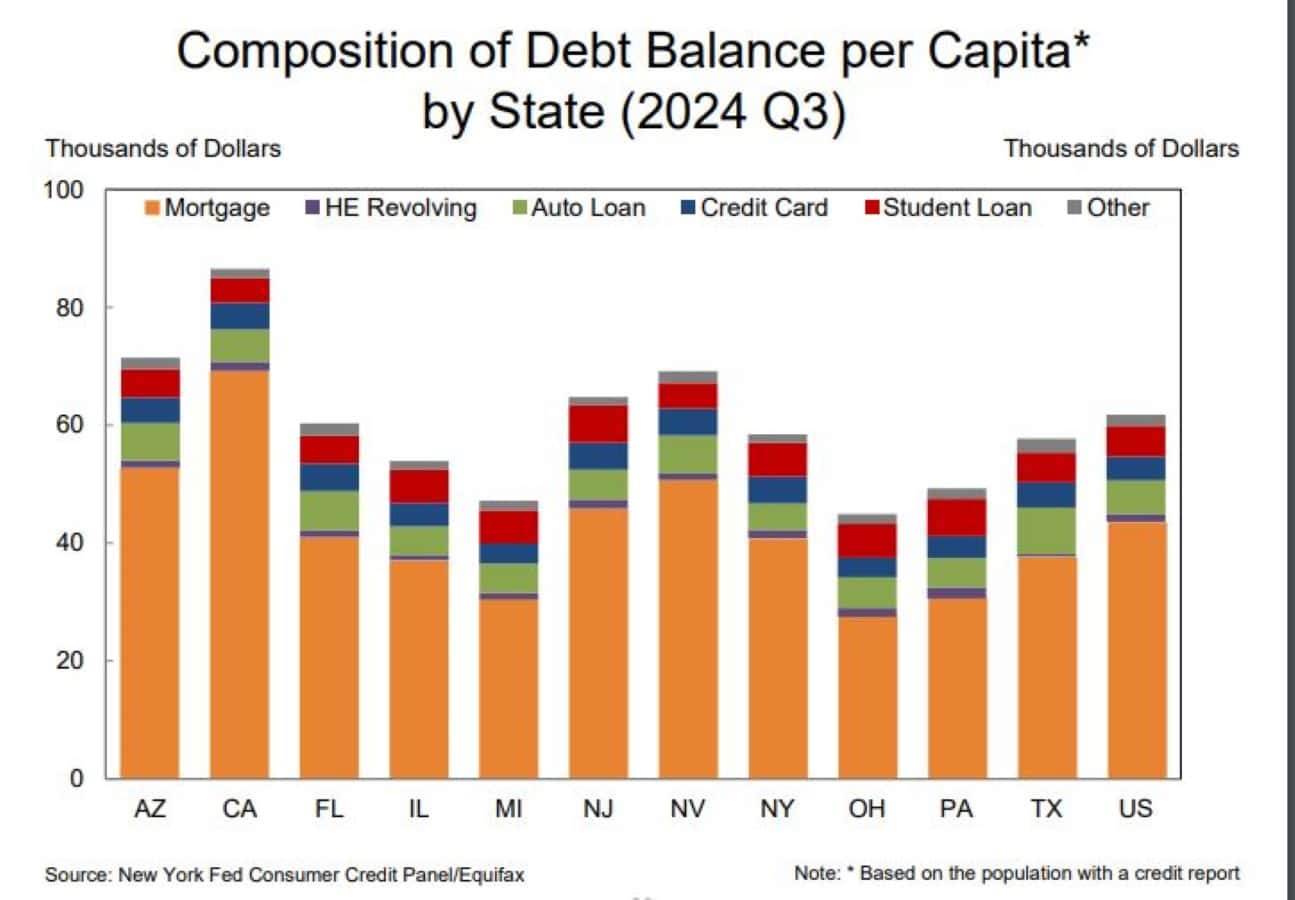

California Tops the Chart for Debt Balances

After normalizing for population, Californians carry a larger debt balance.

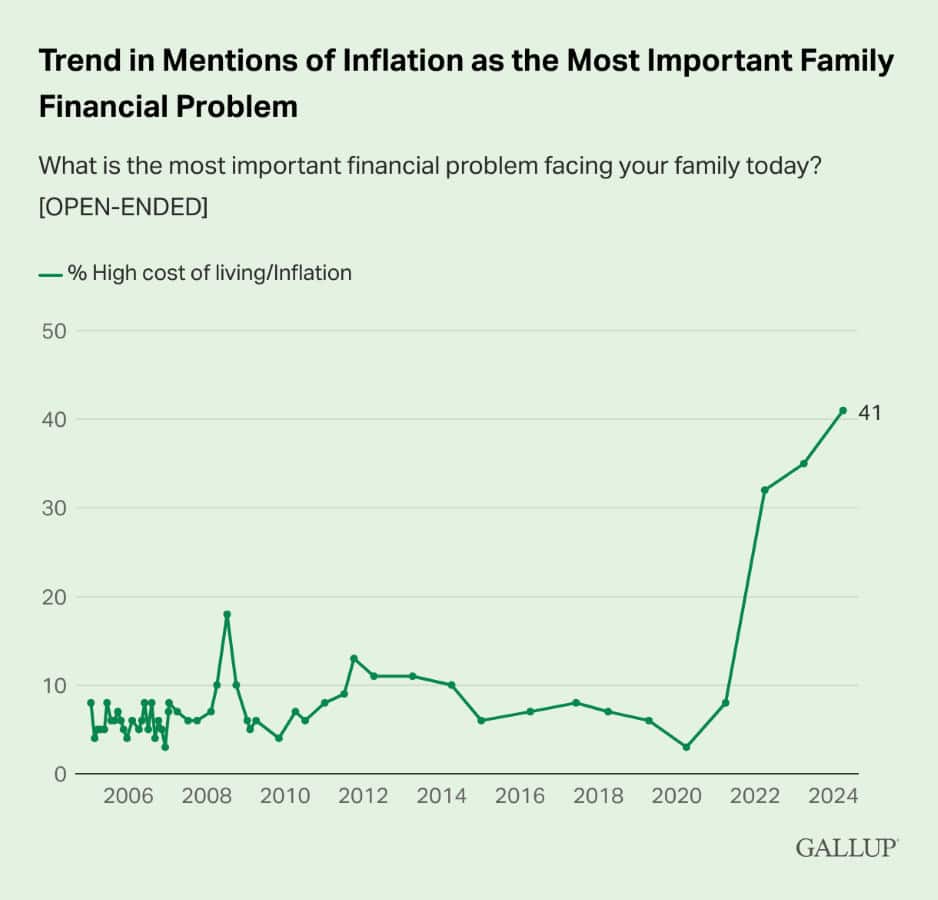

Inflation Top Concern As Per Gallup Poll

For the third consecutive year, the proportion of Americans identifying inflation or high living costs as their family’s top financial problem has hit a new peak. This year, 41% cite the issue, a slight increase from 35% last year.

The latest findings come from Gallup’s annual Economy and Personal Finance poll. Since 2005, Gallup has asked Americans annually to name the top financial problem facing their family without prompting.

Inflation has been the leading concern for the past three years.

Americans Under Increased Financial Stress

Americans are experiencing rising prices in various areas, including purchases made with credit cards, grocery expenses, fuel costs, and other goods. It is plausible that the escalating prices and resulting debt service payments negatively impact borrowers’ financial positions and make it more challenging to meet their financial obligations.

Rising credit card delinquencies are primarily linked to maxed-out borrowers and their balances. Since 2020, the proportion of maxed-out borrowers has been climbing, leading to notably higher delinquency transition rates among this group and overall. To reverse this trend, we need to see a decline in delinquency transition rates among maxed-out borrowers or a decrease in their share.

Unfortunately, current data show no signs of improvement in these areas. Without changes, credit card delinquencies are poised to keep increasing.

Like Financial Freedom Countdown content? Be sure to follow us!

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees. Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

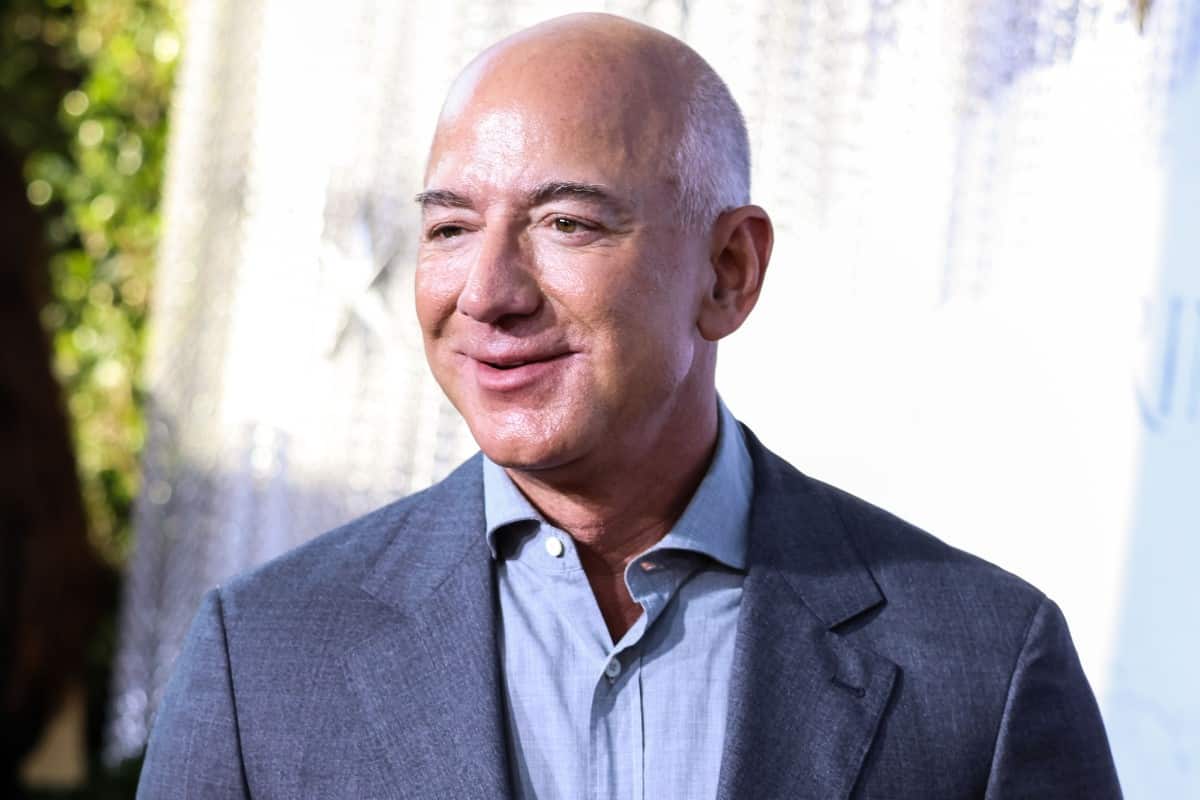

Jeff Bezos’ Move Sparks Intense Debate Over Tax Policies

Amazon tycoon Jeff Bezos made waves in recent headlines by announcing his move from Seattle to Miami. This unexpected decision has piqued interest, sparking speculation about the motives behind the relocation and its potential long-term impacts for Washington State.

Jeff Bezos’ Move Sparks Intense Debate Over Tax Policies

Trump Tax Cuts Expiring Soon: Action Steps You Need to Take Now

Several key elements of the Tax Cuts and Jobs Act (TCJA) are scheduled to lapse by 2025. This pivotal tax reform, implemented during President Trump’s tenure, brought substantial changes to the U.S. tax structure. With the expiration drawing near, it’s crucial for individuals to take proactive steps in their tax planning.

Trump Tax Cuts Expiring Soon: Action Steps You Need to Take Now

The projected depletion dates for Medicare and Social Security have been extended as reported in the annual trustees report for Social Security and Medicare released on Monday. However, officials caution that without significant policy changes, these programs may still be at risk of failing to deliver full benefits to retiring Americans.

The Social Security system is undergoing significant changes starting in 2025, with updates poised to affect beneficiaries and workers nationwide. From reduced Cost of Living Adjustments (COLAs) to increased Medicare premiums and tax thresholds, these changes are a response to shifting economic and demographic trends. It’s crucial to understand how these adjustments will impact you.

Social Security Shake-Up: Key Changes Coming in 2025 That Could Impact Your Benefits

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.