California’s $2 Billion Deficit Sparks Warnings Of Future Fiscal Turmoil Under Newsom’s Leadership – Financial Freedom Countdown

California’s Legislative Analyst’s Office has projected a $2 billion budget shortfall for the 2025-26 fiscal year, warning that despite higher-than-expected tax revenues, the state cannot afford to expand new programs.

This projection comes as Gov. Gavin Newsom prepares his budget proposal for January while grappling with economic challenges, spending pressures, and political maneuvering during his final years in office.

Stock Market Gains Buoy Tax Revenues

California’s tax revenues outpaced projections by $7 billion this year, thanks largely to surging stock market gains, including compensation payouts from major tech players like Nvidia.

However, this windfall is offset by more than $10 billion in unplanned expenditures, driven by school funding mandates, wildfire recovery efforts, rising healthcare caseloads, and voter-approved initiatives.

Warning Signs in California’s Economy

Despite the revenue bump, economic challenges loom. Soft consumer spending, rising unemployment, and lackluster job creation outside the government and healthcare sectors hint at vulnerabilities.

The Legislative Analyst’s Office cautioned about the sustainability of rising state income tax revenues in this uncertain environment.

Legislative Analyst’s Independence in Question

Last year, the Legislative Analyst’s Office estimated a $68 billion deficit, frustrating Newsom, whose budget calculated a smaller $38 billion gap. Criticizing media focus on the higher estimate, Newsom sparked debate about fiscal transparency.

Legislative Analyst Gabriel Petek defended his office, emphasizing the importance of its independent role in advising the Legislature.

Spending Cuts From Summer Persist

California’s $298 billion budget passed this summer included drastic measures to address deficits, such as pausing business tax credits, cutting state operations, and reducing funding for housing, prisons, and health programs. The state was forced to dip into reserves which were kept aside as “rainy day” fund.

These measures, while stabilizing the fiscal outlook temporarily, may hinder broader efforts to bolster services.

Budget “Roughly Balanced” but Spending Limits Loom

The report underscores that while California’s budget is “roughly balanced” this year, operating deficits could swell to $30 billion annually by 2028-29.

These financial constraints, combined with uncertainties tied to federal policies under a potential Trump administration, could stymie Newsom’s proposed economic recovery plans and expanded programs.

Assembly Speaker Urges Caution

Assembly Speaker Robert Rivas supported a conservative approach, stating that this is “not a moment for expanding programs, but for protecting and preserving services that truly benefit all Californians.” His comments highlight growing recognition of the need for fiscal prudence.

Exodus From California Continues

The latest report from the non-partisan California Legislative Analyst’s Office (LAO) highlights a concerning trend: more taxpayers are leaving California than moving in.

Between 2021 and 2022, even as the pandemic waned, the state continued to see a net outflow of residents, signaling that migration patterns are shifting.

The Potential for Long-Term Revenue Strain

Should this net migration out of California continue, experts warn it could eventually place strain on the state’s finances.

The state’s budget relies heavily on personal income tax revenue. Chas Alamo, Principal Fiscal and Policy Analyst for the LAO cautioned that “if this trend persists, it could act as a drag on the state’s primary revenue stream.”

Shifting Demographics of Those Leaving

One of the most striking findings in the LAO report is a shift in who is leaving the state.

During the earlier phases of the pandemic, lower-income households were the primary group departing California.

However, post-pandemic data now show a significant increase in middle- and higher-income households relocating to other states.

Income Tax Reliance Adds to Risks

California’s dependence on personal income tax is one of its financial vulnerabilities.

The state collects nearly half of its revenue from a relatively small portion of its highest earners. As wealthier households increasingly leave the state, the long-term implications could include more pronounced budget shortfalls.

Newsom’s Spending Priorities at Odds With Fiscal Reality

Newsom’s administration has pushed for additional spending, including $750 million annually in tax credits to bolster Southern California’s film industry and a backup disaster relief fund.

The governor has also called for a special legislative session to allocate more funds to the state Department of Justice to litigate against a possible second Trump administration.

Wildcards From Washington

California’s economy remains especially vulnerable to federal policy changes, including potential tariffs and immigration restrictions under President-elect Donald Trump.

Federal disaster aid, a lifeline for wildfire-stricken California, also faces potential cutbacks in reprisal for political disagreements.

The Road Ahead for Newsom

With California’s fiscal future tied to volatile economic and political factors, Newsom will face mounting pressure to balance his policy ambitions against a deteriorating fiscal outlook.

His upcoming January budget proposal may offer clearer insights into how he intends to navigate these challenges while securing the state’s long-term financial stability.

Can California Weather the Fiscal Storm?

As California braces for mounting deficits in the coming years, the choices made in the next budget cycle could determine whether the Golden State can maintain its commitments without sacrificing economic growth.

All eyes will be on Newsom’s January plan—and the challenges he’ll face in reconciling it with the state’s fiscal reality.

Like Financial Freedom Countdown content? Be sure to follow us!

The 10 States Taxing Social Security in 2024 and the 2 That Just Stopped

While many bask in the belief that their golden years will be tax-friendly, residents in nine specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits.

This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits.

Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees.

Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

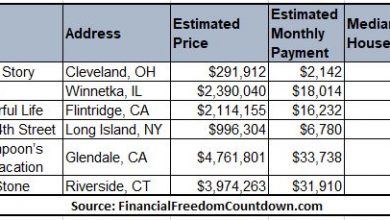

Exploring Government Programs Granting Free Land for Affordable Homeownership: From Colorado to Iowa

Small towns across the US are offering free land for those ready to build homes and contribute to their communities. As housing costs soar nationwide, these towns are innovating to attract new residents and revitalize their local economies. From the Midwest to the Mountain states, these programs offer more than just affordable homeownership; they invite you to join a tight-knit community and embrace a whole new way of life.

Exploring Government Programs Granting Free Land for Affordable Homeownership: From Colorado to Iowa

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.