Are You Living In One Of The 10 States That Still Tax Social Security Benefits? Also 2 States That Finally Stopped In 2024 – Financial Freedom Countdown

While many envision tax-friendly golden years, residents in ten states face a harsh reality as their Social Security benefits are taxed. In contrast, two states are offering relief by ending their practice of taxing these benefits. And one state has a phased implementation to end taxation of Social Security benefits.

This shift highlights the complexities of retirement planning in the U.S. and underscores the importance of staying informed about changing tax laws. Are you living in one of these states? Discover how these tax changes might impact your retirement strategy and whether it’s time to reconsider your locale for those serene post-work years.

Colorado

In Colorado, individuals younger than 65 by the end of the tax year can deduct either $20,000 or their taxable pension/annuity income included in the federal taxable income, whichever is less. For those aged 65 and above by the end of the tax year, Social Security benefits are not subject to state taxes.

Connecticut

For Connecticut residents, Social Security benefits become taxable when your adjusted gross income (AGI) exceeds $75,000, or $100,000 for those filing jointly. Beyond this income threshold, 25% of Social Security income becomes taxable at the state level.

Kansas

In Kansas, Social Security income is taxable for individuals whose AGI exceeds $75,000.

Minnesota

Social Security income in Minnesota is subject to state taxes for individuals with an AGI over $82,190, or $105,380 for joint filers, and $52,690 for those married but filing separately.

Montana

Montana includes Social Security income in state taxable income to the same extent it is included in federal taxable income.

New Mexico

For New Mexicans, Social Security benefits are taxable for those earning more than $100,000, or $75,000 for those filing separately, and $150,000 for surviving spouses or those filing as head of household or jointly.

Rhode Island

Social Security benefits in Rhode Island are taxable if retirement benefits are received before reaching full retirement age (typically 67) or if the AGI exceeds $101,000 for singles or heads of household, $126,250 for joint filers, or $101,025 for those married filing separately for the 2023 tax year. Individuals below these income thresholds may exempt up to $20,000 of their retirement income.

Utah

Utah imposes taxes on Social Security benefits for individuals earning more than $45,000, or $75,000 for heads of household or those married filing jointly, and $37,500 for married filing separately. Those under these income levels may be eligible for a nonrefundable tax credit.

Vermont

In Vermont, Social Security is taxable for individuals with AGIs above $60,000, or $75,000 for those married filing jointly. A partial exemption applies for incomes between $50,000 and $59,999 ($65,001 and $74,999 for joint filers).

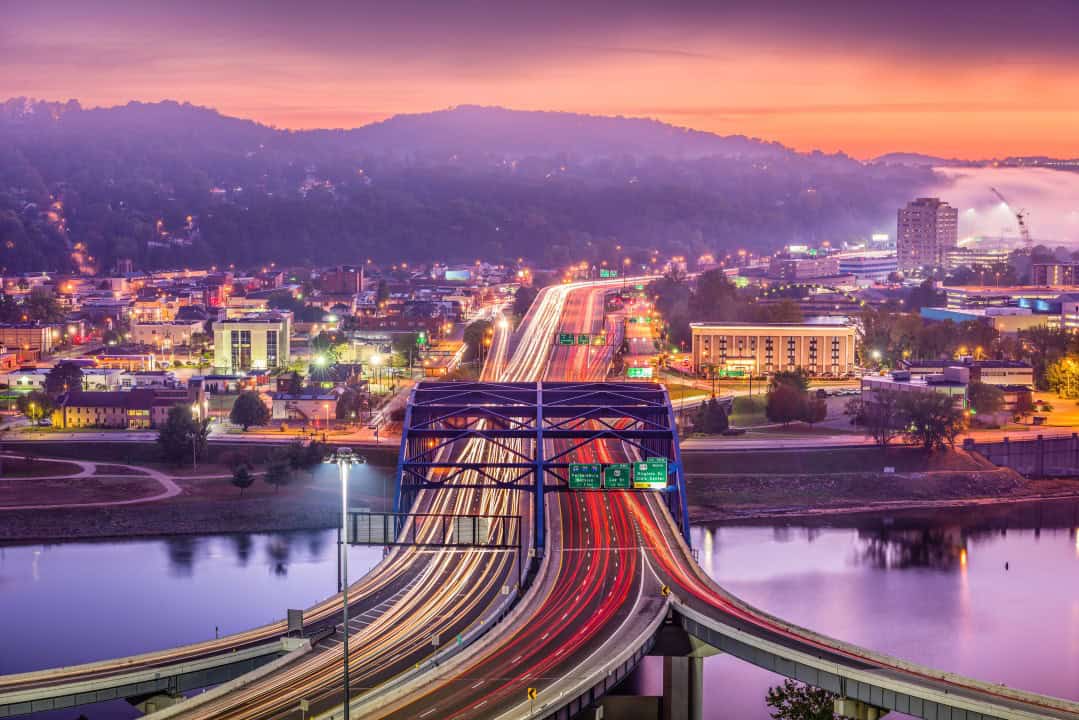

West Virginia

West Virginia passed a law to progress from partially taxing Social Security to completely eliminating taxation in 3 years.

West Virginia won’t tax your Social Security benefits if your federal adjusted gross income is $100,000 or less for married couples filing jointly or $50,000 or less for all other taxpayers

However, if your income is greater than the applicable dollar amount, West Virginia will levy a state income tax on your Social Security payments to the same extent you must pay taxes on that income to the federal government.

Good news for West Virginia resident is the bill phasing out tax on Social Security benefits has been signed into law. Retroactive to Jan. 1 of this year, it applies to 35% deduction for 2024, 65% for 2025 and 100% deduction on Social Security income for 2026 taxes and beyond.

Welcome Relief for Missouri and Nebraska

As of 2024, Missouri and Nebraska join the list of states that no longer tax social security income.

Balancing Taxes and Lifestyle

In the ever-evolving landscape of tax laws and retirement planning, staying informed and consulting with a tax advisor for the most current information is paramount. While the tax implications of where you choose to retire are significant, remember that taxes are just one piece of the puzzle. Quality of life, access to healthcare, proximity to loved ones, and recreational opportunities also play critical roles in selecting your ideal retirement haven. As you navigate the complexities of retirement tax planning, balance these considerations with the fiscal realities. By doing so, you’ll ensure that your retirement years are not only financially sound but also rich in the experiences and connections that truly matter.

Revealing the Income Needed to Join the Top 1% in Every State: Surprising Facts That Prove NYC Isn’t Number One!

SmartAsset’s latest study uncovers the earnings needed to join the top 1% in every state, highlighting surprising differences in living costs nationwide. Shockingly, New York doesn’t even make the top five, even though coastal states lead the list.

Discover the Secrets of 401(k) Millionaires Building Wealth as Their Numbers Surge This Year

Fidelity’s analysis of 24 million 401(k) accounts across 26,000 employer-sponsored plans revealed that the number of 401(k) “millionaires” reached 497,000 last quarter, marking a 2.5 percent increase from 485,000 in the first quarter.

Discover the Secrets of 401(k) Millionaires Building Wealth as Their Numbers Surge 43% This Year

Home Equity Offers A Lifeline for Older Homeowners, but a Dire Future for Those Without

Many homeowners over 60 see their homes as more than just a place to live; they are cornerstones of their financial security and retirement plans. This group, which boasts a nearly 80% homeownership rate, has not only built emotional attachment with their homes but also views the equity accumulated as a vital safety net for their golden years. According to a Fannie Mae study, a significant portion of this demographic is planning to age in place, relying on their homes as a key part of their financial strategy for a comfortable retirement.

Home Equity Offers A Lifeline for Older Homeowners, but a Dire Future for Those Without

Deciding when to claim Social Security benefits is a critical decision for retirees. Two common strategies are claiming Social Security at age 62 and preserving retirement funds or using 401(k) savings and delaying Social Security until age 70. Each approach has its advantages and drawbacks, influenced by individual financial situations and goals.

Smart Retirement Planning: Should You Use Your 401(k) to Delay Social Security Until 70?

Protect Your Retirement: Crucial Strategies to Shield Your Savings During Financial Turbulence

In an era of growing financial risks, investors usually rely on the security of bonds. However, with rising inflation, many are seeing their retirement plans unravel as bond funds faced unprecedented losses in 2022 and continue to decline this year.

Protect Your Retirement: Crucial Strategies to Shield Your Savings During Financial Turbulence

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.